Birdee’s recent CSSF approval means discretionary management for all

What is finance?

For many finance is conceptual, mythical almost — a little bit of everything and a whole lot of nothing.

Personal finance is slightly better, still vague but at least dragging the investor into the picture. The founders of Birdee, a digital, portfolio-management platform, wanted to zoom in even further to money, your money.

“People know exactly what money means, but very few people care about what finance means,” said Geoffroy Linard, Director, Birdee. “We don’t speak about finance or your portfolio, we ask questions about your money and your objectives.”

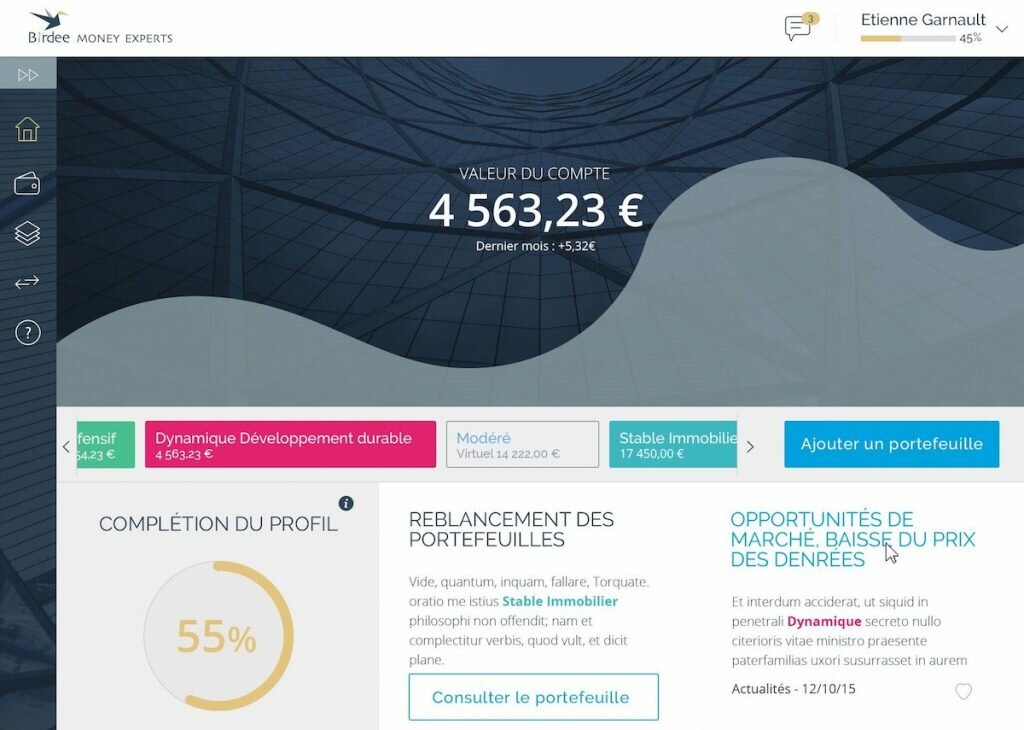

Based on that information and a mandate to manage their money, Birdee makes discretionary management available to mainstream account holders, giving them complete oversight: “We don’t sell a product. We sell a service, but clients can look at the account whenever they want, on a computer or a smartphone,” he added.

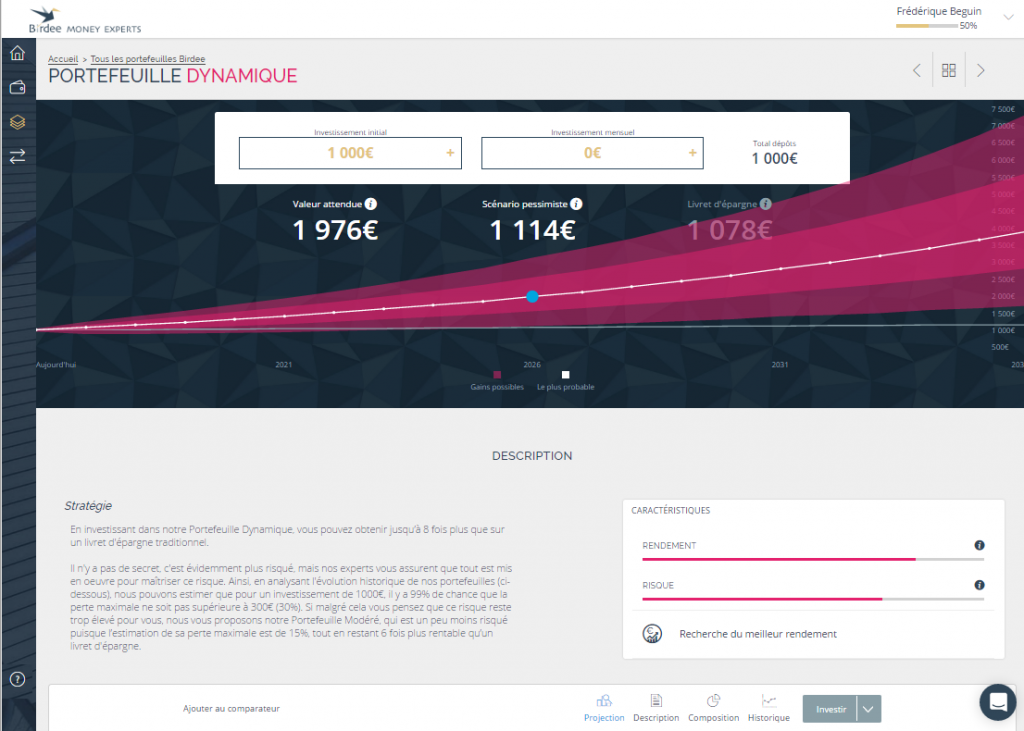

Users with €1,000 or more and no experience can login, transfer an amount, set their strategy based on life goals and lifestyles and begin taking steps toward reaching their objectives.

“We bring the tools of private bankers to your own desk…We’re democratizing private banking.”

With the help of an algorithm to quickly build and manage high-quality portfolios, along with inexpensive and liquid ETFs, Birdee developed a way to provide traditionally costly services at a low cost.

“We bring the tools of private bankers to your own desk. In the past, they were reserved for HNWI, but with new technology, we make them available to people managing small amounts,” Linard said. “We’re democratizing private banking.”

On May 12, after an eight-month process, Birdee reached a significant milestone: the receipt of its final signature from the the Minister of Finance and approval from the CSSF. Its B2B model is well on its way, and with this last sign off, along with approval from Luxembourg’s insurance regulator (Commissariat aux Assurances), its B2C offer can launch in the coming weeks.

“The application process was useful for us and for them,” Linard said. “We had a long meeting halfway through where they asked questions to better understand the business case. I had many exchanges with them, and they helped us clarify some issues.”

While faster than the regulatory bodies of larger countries, the waiting time for approval is still a challenge for startups, who have employees on the payroll as they wait for permission to go to market.

“We don’t speak about finance or your portfolio, we ask questions about your money and your objectives.”

Birdee’s application process took twice as long as the team had anticipated, but was ultimately a positive experience that forced them to re-evaluate their operating processes and KYC policy.

The initial idea for the startup came one and a half years ago, when Gambit Financial Solutions saw the need to overhaul the user experience with regard to savings management. Take one look at its platform — which achieves the same clean, user- friendly appeal of a social media dashboard — and it seems they have done just that.

By incorporating gamification elements, Birdee has successfully created a welcoming application, starkly different from the array of intimidating investment interfaces out there. Uniquely, its simulation feature lets clients invest an unlimited amount of virtual money, map its progress and test if their objectives are achievable. The experience is entirely digital and paperless.

Gone are the days of earning worthwhile interest on traditional savings accounts, but with Birdee’s service and a minimal amount of involvement, the average account holder can take matters into their own hands. The trick is motivating users, with little time or money-management experience, to take that step.

“During recent years banks and asset managers have spoken about the financial world — shares, bonds, derivatives, many difficult words that nobody understands. We say that that’s not the right approach,” Linard explained.

As a young company, Birdee was drawn to lux future lab because of the development support offered. Through the lab’s network, they met different banks in the BNP Paribas Group and received guidance during the hunt for a custodian bank.

With the CSSF’s approval in its pocket, Birdee can look to the future. After establishing itself in Luxembourg, Belgium and France, it will turn to the Netherlands and Switzerland for broader growth. Soon, it plans to expand its market news and produce its own articles — about money, not finance.